Next month, our team at Mobisoft will be showcasing Mobisale at the NBWA 2025 show in Las Vegas. That’s why I wanted to take a moment to talk directly to beer and beverage distributors across America: you deserve more.

For decades, distributors have been the quiet engine behind America’s beverage economy. You are the ones fueling local growth, keeping products available in every town and city, and maintaining strong relationships with thousands of retailers, bars, and restaurants. Without you, the industry doesn’t move.

The Backbone of the Industry

According to the National Beer Wholesalers Association (NBWA), America’s 3,000 independent beer distributors directly employ more than 141,000 people and contribute nearly $23 billion in wages and salaries. The broader beer industry supports more than 2 million jobs across the supply chain, from brewers to truck drivers to bartenders (NBWA, 2024). Distributors are also critical tax generators, contributing billions in federal, state, and local revenues that support schools, infrastructure, and community programs.

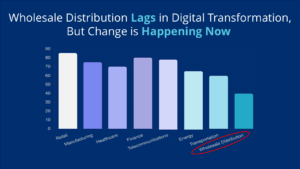

This is not just about beverages; it’s about economic impact and community vitality. Yet despite this central role, distributors too often work with technology stacks that lag behind the industries they serve.

To put this in perspective, the economic footprint of beer distributors rivals other major industries. The grocery sector employs around 2.8 million workers across the U.S., while the automotive parts manufacturing sector supports roughly 900,000 jobs (U.S. Bureau of Labor Statistics, 2023). With more than 141,000 direct employees and over 2 million jobs tied to the wider supply chain, distributors stand shoulder to shoulder with these industries in terms of employment and community impact. This scale underscores why keeping distributors technologically competitive is not just an industry issue; it’s a national economic priority.

But here’s the challenge: while the industry around you has changed rapidly, many distributors are still being left behind in digital transformation. And that gap is widening.

Think about how easy it is to order groceries, hail a ride, or pay a bill from your phone. Now imagine a retailer trying to place a beverage order with outdated systems. The gap between what customers expect and what distributors can deliver has never been wider.

Are You Meeting Expectations in 2025?

Your customers have moved on from yesterday’s buying experience. They’re used to seamless digital interactions everywhere in their lives, whether ordering groceries, paying bills, or booking travel. They expect the same from you.

If your B2B portal is just a static website, not a native mobile app that integrates tightly with your ERP, you’re already behind. Today’s buyers want to:

- Order in seconds from the palm of their hand.

- Scan barcodes, enter quantities, and submit orders instantly.

- Download invoices on demand and pay them with a credit card.

And it’s not just customers. Your field reps also deserve more. They don’t just want digital versions of old processes; they need tools that actively help them sell more, faster, and smarter. Guided selling workflows, real-time inventory, and customer insights should be standard, not optional.

Expanding Customer Expectations

B2B buyers increasingly expect the same seamless experiences they enjoy as consumers. A recent McKinsey report found that 70% of B2B buyers now expect fully digital self-service options for ordering, reordering, and account management (McKinsey & Company, 2023). Payment flexibility, real-time visibility, and 24/7 access are no longer “extras” but table stakes.

For beverage distributors, this means portals and apps need to feel as intuitive as Amazon or DoorDash. Every minute of friction risks a lost order or a frustrated customer.

AI Isn’t a Buzzword; It’s a Game Changer

We’ve all heard the AI hype. But in distribution, AI isn’t hype; it’s already here, and it’s already working.

With tools like Mobisale Genie, reps are growing sales and saving hours of administrative work every week. AI-powered order recommendations, automated workflows, and predictive insights are transforming the way distributors operate.

This isn’t about replacing people. It’s about giving your team superpowers; the ability to anticipate customer needs, make smarter decisions on the fly, and close more business with less effort.

Practical AI Use Cases for Distributors

- Upsell and cross-sell prompts: Suggest complementary products at checkout or during a sales visit.

- Order efficiency: Processing texts, images and voice notes customers sends your field reps into orders in a click.

- Demand forecasting: Predict order volumes based on seasonality, promotions, and past behavior.

- Route optimization: Cut down miles and fuel costs while ensuring timely deliveries.

- Credit and risk monitoring: Flag unusual ordering patterns or potential payment issues before they become problems.

Accenture reports that AI in supply chain management can reduce forecasting errors by up to 50% and lower lost sales by 65% (Accenture, 2024). For distributors, that’s not incremental improvement—it’s transformational.

AI isn’t a separate system that requires a steep learning curve—it blends seamlessly into the tools your team already uses. For a sales rep, it might mean opening the same mobile app they’ve always used, but now seeing recommended products pop up based on purchase history. For a route driver, it’s real-time alerts about traffic or delivery windows, automatically adjusting their schedule. For a manager, it’s dashboards that surface at-risk accounts before they churn.

In other words, AI doesn’t replace workflows—it quietly enhances them, making every task faster, more accurate, and more profitable without adding complexity.

Don’t Replace Your ERP; Integrate It

One of the biggest traps in digital transformation is the belief that progress requires a full ERP replacement. Multi-year projects that cost millions and disrupt operations aren’t the answer.

ERP replacement projects often cost millions of dollars and can take years to complete. Panorama Consulting reports that the average ERP project lasts 30 months and consumes 3–5% of annual revenue, with nearly 60% experiencing cost overruns (Panorama Consulting, 2023). Gartner adds that more than half of ERP projects face significant delays, and 75% fail to deliver ROI on schedule (Gartner, 2023). Integration avoids these sunk costs by extending the value of your existing investment. By modernizing through integration rather than replacement, distributors sidestep unnecessary disruption and free up capital to invest in growth, sales tools, and enhanced customer experiences.

The smarter path? Integrate your ERP with a next-generation B2B commerce platform like Mobisale.

Integration unlocks new capabilities across:

- Order taking, faster, simpler, error-free.

- Merchandising, real-time visibility and insights.

- Route accounting, streamlined and accurate.

- B2B eCommerce, modern, mobile, and always connected.

The result is speed: ROI measured in months, not years.

The Future of Distribution Technology

Where is the industry heading next?

- Conversational analytics: Your reps can “chat” with your organization data just like they do on ChatGPT, directly inside their sales app.

- Voice-enabled ordering: Retailers dictating orders directly into their devices.

- Augmented reality (AR): Reps using AR overlays to optimize shelf layouts.

- Blockchain: Ensuring product traceability and compliance across the supply chain.

Industry analysts predict that many of these innovations are closer to mainstream than most distributors realize. Gartner estimates that by 2026, more than 30% of B2B companies will enable voice-assisted ordering through mobile and IoT devices (Gartner, 2023). IDC projects that 70% of large distributors will deploy some form of augmented reality (AR) merchandising or training tools by 2027 (IDC, 2023). And Deloitte reports that blockchain applications for supply chain traceability are expected to grow at a CAGR of over 50% between 2023 and 2030, moving quickly from pilot projects to operational adoption (Deloitte, 2023).

These aren’t distant possibilities; they are fast-approaching realities. Distributors who build their digital foundation now will be ready to capitalize when these technologies hit critical mass.

Each of these innovations builds on a foundation of integration and digital transformation. Without that groundwork, distributors will find themselves locked out of the next wave of competitive advantage.

By the Numbers: Why Digital Matters

- The U.S. beverage alcohol market is worth more than $250 billion annually (IWSR, 2023).

- Distributors deliver products to over 650,000 retail accounts nationwide (NBWA, 2024).

- McKinsey reports that companies embracing digital B2B sales grow revenue 2–3 times faster than laggards (McKinsey & Company, 2023).

These numbers speak clearly: the stakes are too high for distributors to operate with outdated tools.

With a $250 billion market at stake, outdated tools don’t just slow operations; they put distributors at risk of losing share to competitors who adopt digital-first solutions. Delivering your market share of the 650,000 retail accounts nationally requires speed, accuracy, and visibility that spreadsheets and legacy portals simply can’t provide. That’s where Mobisale creates a measurable advantage: by integrating seamlessly with your ERP, it enables faster order cycles, reduces errors, and gives reps the digital edge they need to win more business in an increasingly competitive market.

The Time to Act Is Now

Beer and beverage distributors have always carried the industry. In 2025, it’s time for technology to carry you forward.

Your customers are ready for more. Your sales reps are ready for more. And you deserve more.

That’s why Mobisoft is committed to helping distributors modernize quickly, effectively, and profitably.

We’ll be on the ground at NBWA 2025 in Las Vegas, ready to show you exactly how.

Stop by the booth. See the demos. Bring your toughest challenges. Let’s talk about how you can thrive in this next era of distribution.

See you at NBWA.

References

Accenture. 2022.

Supply Chain AI: Driving the Future of Operations.

Deloitte. 2023. Blockchain in Supply Chain Forecasts.

Gartner. 2022. ERP Implementation Risks and ROI.

Gartner. 2023. Emerging Trends in B2B Commerce.

IWSR. 2023. Drinks Market Analysis, United States.

IDC. 2023. AR and Digital Transformation in Distribution.

McKinsey & Company. 2023. The New B2B Growth Equation.

National Beer Wholesalers Association (NBWA). 2024. Economic Impact Report.

Panorama Consulting. 2023. ERP Report.

U.S. Bureau of Labor Statistics. 2023. Employment by Industry.